Would you prefer to learn through a video? Click here!

Many homebuyers are shocked to learn that getting a mortgage with zero money down is possible, and they are even more surprised to find that first-time homebuyers can take advantage of this opportunity, too. In fact, there are five core strategies you can use to lower your down payment, no matter which mortgage company or loan type you choose. This article will explore these strategies to help you understand how to buy a home with no money down.

What is a Zero-Down Mortgage?

A zero-down mortgage is a home loan that does not require the borrower to provide any money at the closing table. To clarify, the loan finances 100% of the home’s purchase price, allowing the buyer to avoid a down payment. These loans are designed to make homeownership more accessible, especially for first-time homebuyers who may not have significant savings.

The Pros and Cons of a Zero-Down Mortgage

While zero-down mortgages offer the advantage of allowing buyers to purchase a home without a down payment, there are benefits and potential drawbacks to consider.

Pros:

- Accessibility: Zero-down mortgages make homeownership accessible to those who may not have substantial savings for a down payment, particularly first-time homebuyers.

- Preserve Savings: Buyers can save for other expenses, such as home improvements, emergency funds, or other financial investments, instead of a down payment.

Cons:

- Higher Monthly Payments: Financing 100% of the home’s purchase price typically results in higher monthly mortgage payments.

- Private Mortgage Insurance (PMI): Many zero-down loans require PMI, which adds to the overall cost of the loan, though VA loans are an exception.

- Stricter Eligibility Requirements: Zero-down mortgage programs often have specific eligibility criteria.

Buying a House With No Money Down

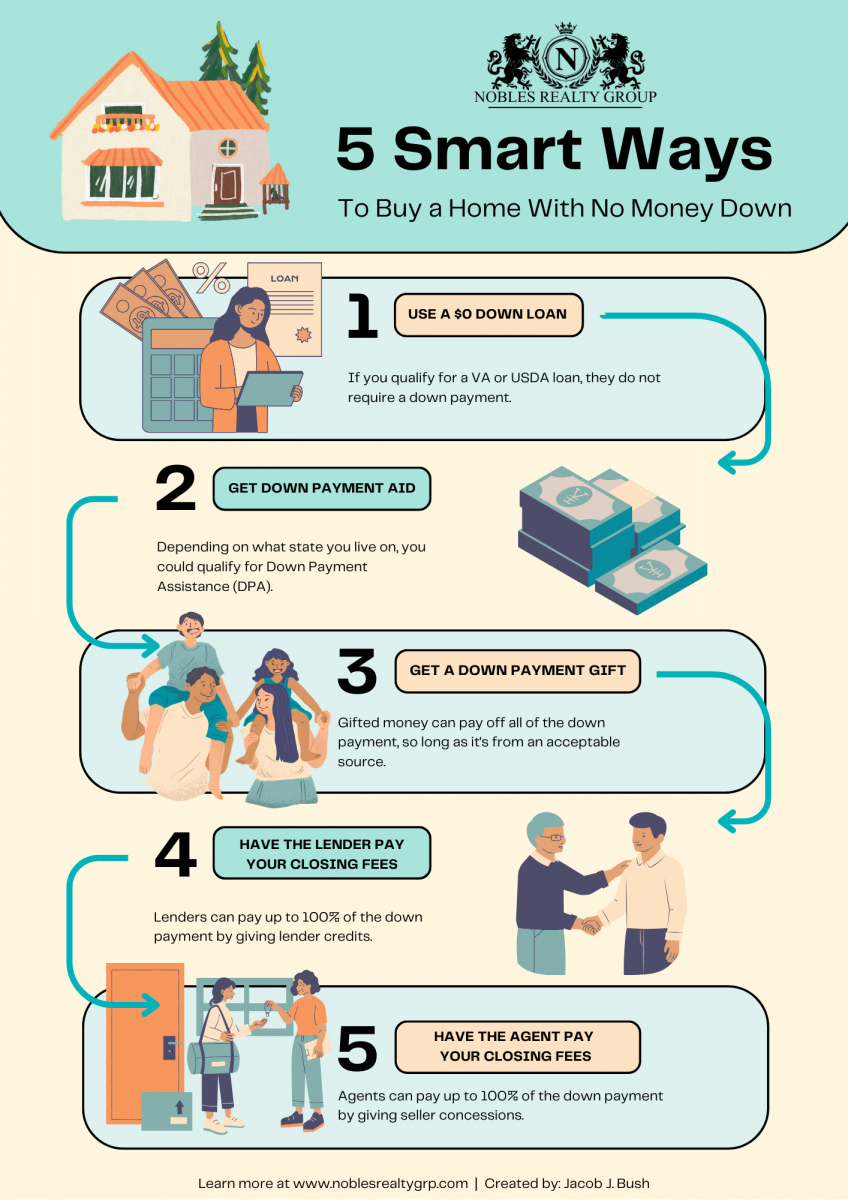

Though it may sound ‘too good to be true,’ with the help of government-backed mortgages, first-time home buyer loans with zero down, and creative financing strategies, you can use one or more of the following five core strategies to buy a home with $0 down. These methods include leveraging zero-down loans, obtaining down payment assistance, receiving down payment gifts, utilizing lender credits, and negotiating seller concessions. By understanding and applying these strategies, you can make homeownership a reality without a hefty upfront investment.

Strategy One: Use a Zero-Down Loan

One of the most straightforward ways to buy a house with no money down is to use a zero-down loan. Government-backed loans, such as VA loans for veterans and active-duty military personnel and USDA loans for rural homebuyers, offer 100% financing options. These loans eliminate the need for a down payment, allowing you to finance the entire home purchase price. To qualify, you must meet specific eligibility criteria, such as military service for VA loans or location and income requirements for USDA loans.

If you don’t qualify for a zero-down loan, there are other low-down-payment options available that might be suitable for you:

- Conventional 97 loans: 3% down, 620 credit score

- Fannie Mae HomeReady loans: 3% down, 620 credit score

- Freddie Mac Home Possible loans: 3% down, 660 credit score

- FHA loans: 3.5% down, 580 credit score

Strategy Two: Get Down Payment Assistance

Many state and local governments offer down payment assistance programs (DPA) to help buyers cover the upfront costs of purchasing a home. These programs can come in the form of grants, low-interest loans, or deferred payment loans, making it easier for buyers to afford a house without a significant down payment. Researching and applying for these programs can significantly reduce your out-of-pocket expenses.

Strategy Three: Ask for a Down Payment Gift

A down payment gift is another viable option for buying a house with no money down. Family members, close friends, or even employers can provide a financial gift to cover the down payment. Following the lender’s guidelines regarding documentation and gift letters is essential to ensure the gift is recorded correctly and accepted.

Strategy Four: Have Lenders Pay Your Fees (Lender Credits)

Lender credits can help reduce or eliminate your out-of-pocket costs at closing. By accepting a slightly higher interest rate, lenders may offer credits to cover closing costs and other fees, effectively allowing you to buy a home with little to no upfront expenses. This strategy can be advantageous if you prefer to keep your initial costs low and are comfortable with a higher monthly payment.

Strategy Five: Have Sellers Pay Your Fees (Seller Concessions)

Seller concessions involve negotiating with the seller to have them cover certain closing costs and fees. This can include expenses like appraisal fees, property taxes, and title insurance. Including seller concessions in your purchase agreement can reduce out-of-pocket costs and make homeownership more affordable.

Want To Get Started?

Buying a house with no money down may seem daunting, but it is entirely possible with the right strategies and loan options. Whether you utilize zero-down loans, explore down payment assistance programs, receive a down payment gift, or negotiate lender credits and seller concessions, there are multiple pathways to achieving your dream of homeownership without a hefty upfront investment.

As an experienced real estate agent, I am here to help guide you through this process and find the best financing options tailored to your needs. Don’t let the fear of a down payment discourage you from owning a home. Contact me today to get started on your journey to homeownership with expert advice and personalized service. Let’s make your dream home a reality!

Authored by: Jacob J. Bush

| Attachment | Size |

|---|---|

| 5 Smart Ways To Buy a Home With No Money Down.png | 0.57 Mb |

-min.png)